Compliance for Start-ups: Why Retroactive Compliance Costs Twice as Much

Learn how Compliance for Start-ups can save you from expensive retroactive fixes. This guide breaks down the pitfalls of reactive compliance and offers proactive solutions.

Retroactive compliance costs twice as much.

While startup founders obsess over product-market fit and user acquisition, they ignore the regulatory ticking time bomb beneath their business model. When regulatory scrutiny arrives, and it always does, companies scramble to patch together compliance programs under pressure.

This emergency approach creates exponential costs that drain resources from your core business activities. It leaves gaps that regulators easily identify and penalize.

The True Cost of Retroactive Compliance

Your fintech just received a letter from state regulators. Suddenly, your compliance "strategy" of crossing fingers and hoping for the best doesn't seem so rational.

The financial multiplier effect of reactive compliance destroys startup budgets fast. Over 60% of fintech companies paid at least $250,000 in compliance fines in 2023. Many faced additional costs for emergency consulting and system overhauls.

Here's what emergency compliance fixes actually cost:

- Engineering resources: Your development team abandons feature development to retrofit compliance into existing systems

- Legal expenses: Attorneys work around the clock at premium hourly rates to address regulatory concerns

- Consultant fees: Emergency compliance experts charge 2-3x their normal rates for urgent projects

- Regulatory penalties: Financial groups paid $10.4 billion in regulatory fines in 2020 alone.

The opportunity costs extend far beyond immediate expenses.

73% of fintech startups fail within three years due to regulatory challenges. They can't secure partnerships or investment while under regulatory scrutiny.

Lost partnerships represent another hidden expense. Banks and institutional partners require solid compliance programs before engaging. When compliance gaps surface during due diligence, deal timelines extend by months or collapse entirely.

Product launches face indefinite delays as teams untangle compliance issues from core functionality. The revenue impact multiplies as competitors capture market share while non-compliant companies remain sidelined.

Would you rather spend $50,000 building compliance upfront, or $200,000 fixing it later while paying regulatory fines?

Problem 1: Backfilled Policies Create Scattered Documentation

Documentation Under Pressure

Rushed policy creation produces a compliance nightmare. You get inconsistent formatting, conflicting standards, and fragmented procedures that confuse employees and fail audits.

Emergency documentation lacks the cohesive structure that regulators expect from mature compliance programs. Teams working under regulatory pressure create policies in isolation. The result? Contradictory requirements across departments.

When your legal team creates an AML policy while your product team writes data handling procedures without coordination, chaos ensues:

- Customer onboarding requirements conflict between departments

- Data retention policies contradict privacy procedures

- Risk assessment criteria vary by team

- Approval workflows overlap and create bottlenecks

Version control becomes impossible when multiple people simultaneously draft overlapping procedures without central coordination. You end up with five different versions of your privacy policy floating around Slack channels.

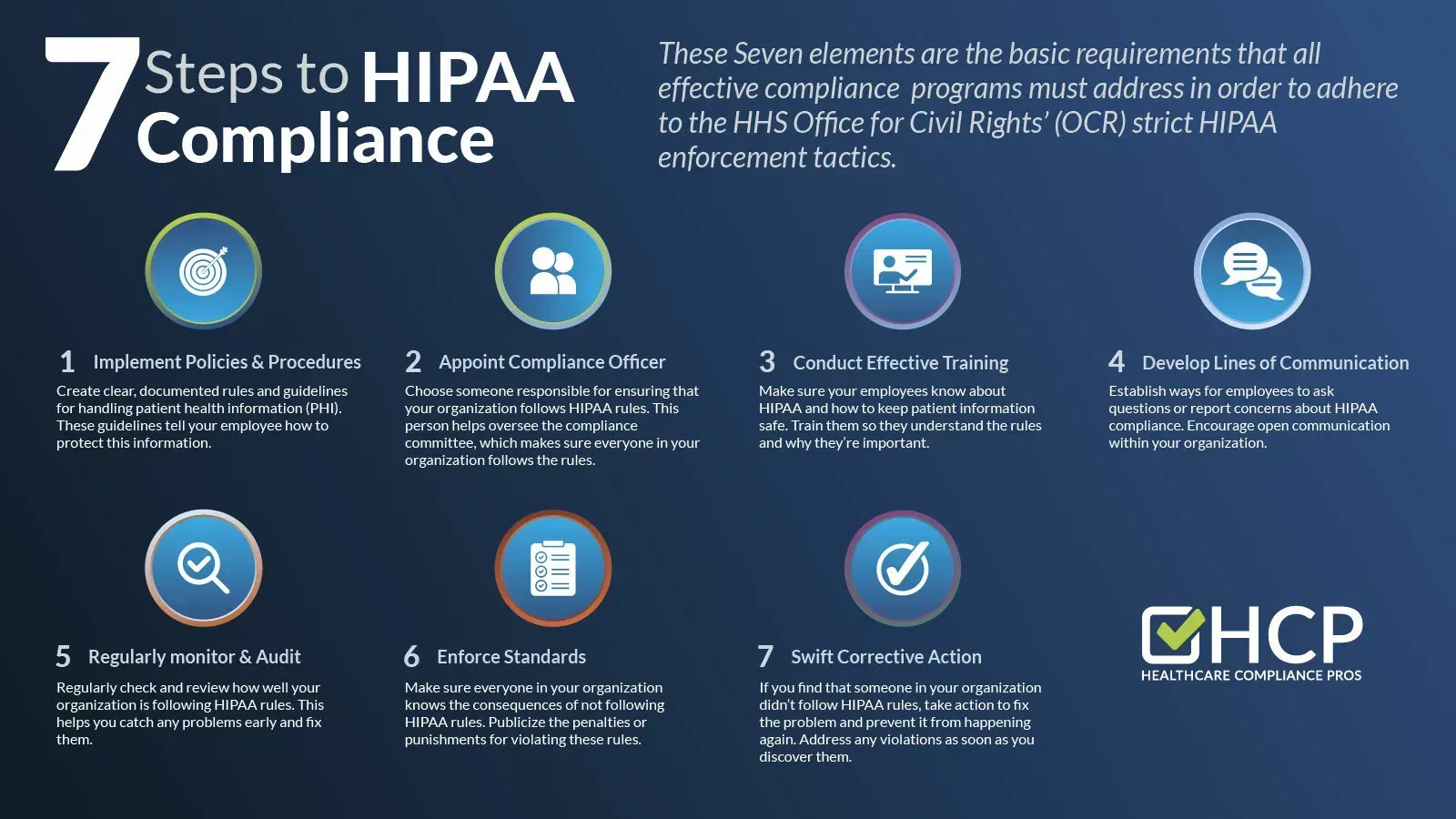

ComplyIQ's systematic framework approach prevents scattered documentation by establishing consistent templates and approval processes from day one. Our experiences at fintechs up to Fortune 100 companies taught us that proactive compliance program design creates documentation that passes regulatory scrutiny, because it follows proven institutional standards.

The Audit Trail Nightmare

Retroactive policies fail to establish version control and approval processes that regulators require. Hasty documentation efforts create compliance gaps that become obvious during examinations.

Regulators spot incomplete audit trails immediately because they understand how documentation should flow. Missing signatures, undefined dates, and unclear approval hierarchies signal poor risk management practices.

Regulators look for specific elements in your documentation:

- Clear effective dates for each policy version

- Documented approval processes with signatures from appropriate stakeholders

- Change logs showing what was modified and why

- Training records proving employees received updated procedures

- Regular review cycles demonstrating ongoing policy maintenance

Don't be the company that tells regulators, "We have that policy somewhere in our Google Drive."

Problem 2: Training Delivered Under Duress vs. Proactive Reinforcement

Crisis Training Fails Retention

Stress-induced learning produces lower retention rates compared to structured compliance education programs. Your employees absorb information poorly when compliance training becomes an emergency response rather than ongoing development.

Crisis-driven training initiatives achieve 40% lower retention rates. Why? Learners focus on immediate task completion rather than conceptual understanding. The pressure to quickly check compliance boxes prevents deep learning that creates lasting behavioral change.

Emergency training sessions lack the repetition and reinforcement necessary for building muscle memory around compliance procedures. Employees forget key details within weeks because they never had time to practice applying the concepts.

During crisis compliance training:

- Employees attend marathon sessions covering months of material in days

- Training focuses on memorizing steps rather than understanding principles

- No time exists for questions, practice scenarios, or skill reinforcement

- Follow-up training gets delayed due to "more urgent" business priorities

- Retention testing reveals knowledge gaps months later

Building Compliance Culture Takes Time

Proactive training creates ingrained behaviors through repeated practice and gradual skill building. Proper compliance programs treat education as culture development rather than information transfer.

Compliance as routine practice emerges from consistent reinforcement and positive feedback loops. When employees understand the reasoning behind procedures, they adapt more readily to new situations and regulatory changes.

Companies integrate compliance training into regular onboarding and professional development cycles. New hires learn compliance alongside product training. Existing employees receive regular updates and refresher sessions.

The difference is substantial. Employees who receive proactive compliance training ask better questions, identify potential issues before they become problems, and treat compliance as part of good business practice rather than bureaucratic overhead.

Problem 3: Untangling Product Decisions from Overlooked Rules

Embedded non-compliant features require expensive engineering rewrites that can consume months of development time. Fintech regulations create complex requirements that affect everything from user interface design to data storage architecture.

Your payments feature seemed brilliant during development. Clean interface, smooth user experience, fast processing. Then regulators review your system and discover your "streamlined" onboarding process violates Know Your Customer requirements.

Now you need to redesign the entire user onboarding flow. You must rebuild database architecture to capture required information. API endpoints need modification to handle additional data points. Mobile apps across iOS and Android platforms require updates. Documentation and user guides need rewrites. Customer support needs retraining on new procedures.

Retrofitting compliance into existing product architectures often proves more expensive than building new systems from scratch. Legacy code intertwines with user experience decisions that seemed logical before regulatory review but now create problems.

Development time multiplies when compliance becomes an afterthought. Engineers must reverse-engineer decisions made without regulatory input. Simple changes like adding disclosure language can require database restructuring and API modifications.

Real examples of compliance retrofitting problems:

- Data Storage Issues: Your customer data structure doesn't accommodate required regulatory fields. This forces database migration and API changes across your entire system.

- User Interface Problems: Required disclosures don't fit your mobile-first design philosophy. This necessitates complete UX redesign for key user flows.

- Integration Conflicts: Your third-party payment processor doesn't support required compliance reporting. You're forced to switch vendors and rebuild integrations.

Regulatory issues represent the top challenge fintech companies face, with product integration complexity increasing costs exponentially compared to early compliance integration.

Early compliance integration prevents costly product pivots by identifying regulatory constraints during the design phase. Companies involve compliance expertise in product planning rather than treating it as a post-launch consideration.

The key insight? Compliance constraints should inform product design, not constrain finished products.

Problem 4: Regulators Don't Accept "We're Working on It"

Regulatory expectations demand immediate compliance, not promises of future fixes. Enforcement actions proceed regardless of your company's intentions or improvement timelines because consumer protection can't wait for convenient implementation schedules.

Regulators don't care about your startup struggles.

Recent legal developments in fintech demonstrate how regulators view retroactive efforts as evidence of poor risk management rather than good faith improvement attempts. Public sanctions accompany enforcement actions, creating reputational damage that extends far beyond financial penalties.

Companies claiming progress while operating non-compliant systems face harsher penalties because regulators interpret ongoing violations as willful disregard for consumer protection. The "we didn't know" defense becomes impossible once regulatory contact occurs.

Consider these real regulatory responses to common startup excuses:

- "We're a small startup with limited resources"

Regulator response: "Consumer protection applies regardless of company size." - "We're building compliance into our next product release"

Regulator response: "Current operations must comply with existing regulations immediately." - "We hired a compliance consultant and they're working on it"

Regulator response: "Hiring consultants doesn't excuse ongoing violations."

The enforcement timeline moves faster than your development cycle. Regulatory letters typically give companies 30-60 days to respond with corrective actions. That's not enough time to rebuild non-compliant systems or implement extensive compliance programs.

Your best defense? Don't give regulators a reason to start enforcement proceedings in the first place.

ComplyIQ's experience helping teams avoid expensive untangling scenarios comes from understanding how regulatory requirements interact with technical architecture. Our background allows us to spot potential conflicts before they become embedded in product systems.

Frequently Asked Questions

How much should startups budget for proactive compliance versus reactive fixes?

Proactive compliance typically costs 60-80% less than emergency fixes because it avoids regulatory penalties, emergency consulting fees, and product architecture changes. Early-stage companies should allocate 3-5% of revenue to compliance rather than facing potential fines that can reach 15-20% of annual revenue.

Do startups get exemptions from regulatory requirements during early growth phases?

No regulatory exemptions exist for consumer protection laws regardless of company size or growth stage. Regulators hold startups to the same standards as established financial institutions because consumer harm occurs regardless of company maturity.

When should companies implement formal compliance programs?

Compliance programs should begin before processing the first customer transaction. Waiting until Series A funding or regulatory contact creates the retroactive compliance problems that multiply costs and reduce results.

What role does fractional compliance leadership play in early-stage companies?

Fractional CCO services provide Fortune 500-level expertise without full-time overhead, allowing startups to build compliance foundations during product development rather than retrofitting systems later. This approach costs less and works better than hiring junior compliance staff.

Should startups build compliance programs in-house or outsource to specialists?

Early-stage companies benefit more from outsourced expertise because specialized knowledge prevents costly mistakes that in-house teams typically make. Internal compliance hiring becomes cost-effective only after reaching sufficient transaction volume and complexity.

How do compliance costs compare between prevention and remediation approaches?

Prevention typically costs 50-70% less than remediation because it avoids regulatory fines, emergency consulting, system rebuilds, and opportunity costs from delayed partnerships and product launches.

What happens when startups ignore compliance until facing regulatory scrutiny?

Companies facing retroactive compliance requirements often experience costs including immediate fines, emergency consulting expenses, product development delays, lost partnerships, and potential business model changes that can threaten company survival.

Conclusion

Proactive compliance prevents the exponentially higher costs that plague companies attempting retroactive fixes.

The four key problems: scattered documentation, poor crisis training, product architecture complications, and regulatory intolerance for delays create a perfect storm of expenses and inefficiencies. Forward-thinking founders recognize that compliance expertise represents necessary infrastructure, not optional overhead.

Rather than gambling with your company's future, consider building compliance foundations while you still control the timeline and costs.

ComplyIQ's fractional CCO services provide the preventive compliance strategy that keeps startups ahead of regulatory requirements rather than scrambling to catch up after problems multiply. Because fixing compliance issues after they happen costs twice as much and works half as well as getting it right from the start.