Compliance Culture: From Sidecar to Core Operational Driver

Learn to transform Compliance Culture through consistent leadership behavior and seamless process integration that accelerates fintech innovation.

Introduction

Three words impacted Revolut's reputation.

"Cultural compliance gaps."

Recent research from Gartner reveals something shocking. Even organizations with strong ethical cultures struggle to prevent noncompliance when clear quality standards aren't built into daily operations.

The core problem isn't technical knowledge gaps or insufficient policies.

It's that compliance culture operates as a "sidecar" function—bolted onto existing operations rather than woven into the company DNA. When accountability becomes scattered across disconnected systems, fintech leaders face mounting regulatory scrutiny. They lack the cultural foundation to support their compliance goals.

The Hidden Cost of Sidecar Compliance

Sidecar compliance treats regulatory adherence as an add-on function. It runs parallel to "real" business operations instead of being part of them.

Teams view compliance as something handled by a separate department. They don't see it as a shared responsibility woven into decision-making processes.

This creates dangerous blind spots. Compliance considerations get overlooked during product launches. They're forgotten in partnership negotiations. Customer onboarding workflows skip crucial steps.

The financial consequences are brutal.

Revolut faced a €3.5 million fine from the Bank of Lithuania for anti-money laundering control failures. These stemmed from cultural compliance gaps rather than technical system deficiencies. Monzo's £21 million FCA penalty exposed how rapid growth without built-in compliance thinking creates vulnerabilities.

These enforcement actions share a common thread. They trace back to cultures where compliance operated as an afterthought rather than a core business principle.

Here's what's really scary: 73% of fintech startups fail within three years due to preventable regulatory compliance issues. Companies invest heavily in compliance technology and

documentation. Meanwhile, they neglect the cultural infrastructure needed to make these systems work.

Poor compliance culture shows up in predictable ways:

- Employee confusion about decision-making authority

- Inconsistent policy application across departments

- Increased vulnerability during regulatory examinations

- Teams compromising on compliance under business pressure

Studies show that 59% of companies compromise on compliance when facing business pressure. That's more than half of all organizations.

Why Traditional Compliance Training Falls Short

Picture this: Your entire team sits through eight hours of annual compliance training. Everyone signs acknowledgment forms. You feel confident about your program.

Six months later, a regulatory examiner finds widespread policy violations.

Sound familiar?

Most organizations approach compliance culture through annual training sessions, policy memorandums, and acknowledgment forms. This memo-driven approach ignores basic behavioral psychology. It doesn't address how people actually change their decision-making patterns under pressure.

One-size-fits-all training programs fail because they ignore role-specific compliance challenges. A product manager needs different compliance thinking skills than a customer service representative. Yet traditional programs treat all employees identically.

Security Magazine reports that 78% of fintech leaders express concern about inadequate compliance training within their organizations. The gap isn't in training frequency. It's in training results.

Annual workshops create momentary awareness that fades quickly. Without reinforcement through daily operations, the impact disappears.

The biggest flaw lies in assuming that knowing compliance rules translates to applying them correctly during high-stakes situations. When teams face tight deadlines, competitive pressure, or unclear scenarios, they default to observing leadership behavior. They don't recall training content.

The Leadership Modeling Problem

When Leaders Skip Their Own Rules

Leadership inconsistency destroys even the most detailed compliance programs. It sends mixed signals about what really matters.

When executives bypass established approval processes, skip documentation requirements, or make exceptions without clear justification, they send a message. Compliance is optional rather than fundamental.

These behaviors often appear subtle but carry enormous cultural weight.

Consider these scenarios:

- A CEO approves partnerships without compliance review

- A CTO deploys features before regulatory assessment

- A VP expedites customer onboarding by skipping verification steps

All communicate that speed trumps compliance when pressure mounts.

Middle management gets caught between conflicting signals. Executives demand compliance outcomes while modeling compliance shortcuts.

The Cascade of Poor Examples

Compliance shortcuts spread through hierarchies following predictable patterns. When senior leaders normalize exception-making, department heads adopt similar approaches with their teams. Individual contributors then rationalize their own rule-bending as consistent with company culture.

This cascade creates normalized deviance. It's a gradual erosion of standards through repeated small compromises.

Each deviation feels reasonable in isolation. But the cumulative effect changes how the organization approaches risk and accountability.

The pattern becomes particularly dangerous during regulatory examinations. Examiners discover inconsistent practices across different departments. What leadership viewed as pragmatic flexibility appears to regulators as control failures that require formal enforcement action.

Corporate Compliance Insights research confirms that ethical culture alone doesn't prevent noncompliance. You need clear quality standards and consistent leadership modeling.

Building Accountability Through Cultural Integration

Embedding Compliance in Daily Operations

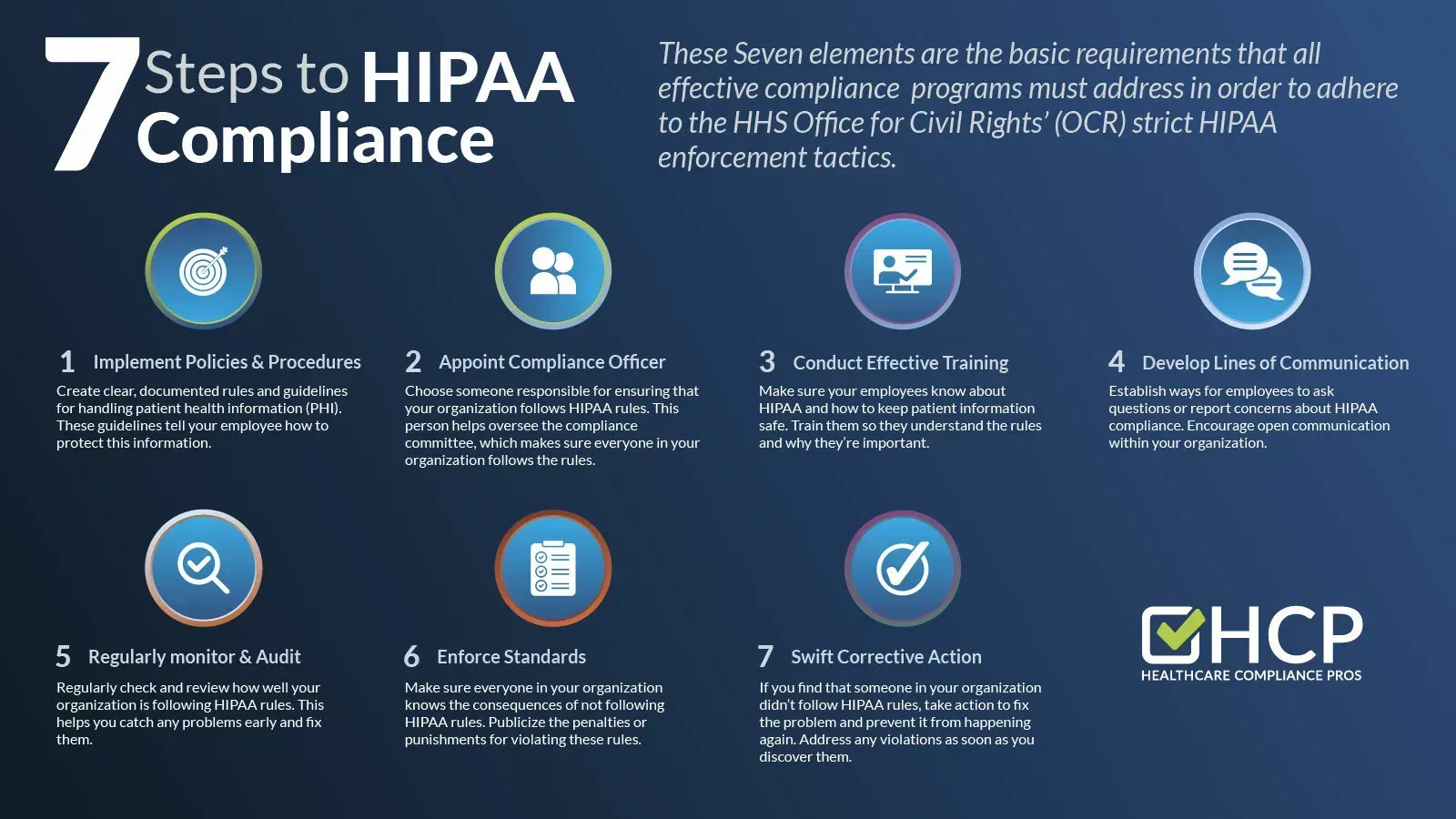

Transforming compliance from a sidecar to a core operational driver requires weaving regulatory considerations into routine business processes. Rather than treating compliance as a separate approval step, you need natural checkpoints that make regulatory thinking feel seamless.

Practical integration starts with connecting individual role performance to broader compliance outcomes. Product managers should have compliance metrics in their performance reviews. Sales teams need regulatory considerations built into their CRM workflows.

Research from The Financial Brand demonstrates how successful fintechs balance growth with compliance risk. They integrate regulatory considerations into customer lifecycle management.

Here's a real example: Instead of having compliance review every marketing campaign after creation, build compliance questions into the campaign planning template. "Does this messaging comply with truth-in-advertising requirements?" becomes part of the creative brief, not an afterthought.

For organizations recognizing they need senior-level compliance leadership without full-time overhead costs, ComplyIQ's fractional CCO services provide the bridge between reactive compliance consulting and expensive in-house teams. This approach helps embed accountability into company culture from the leadership level down.

The goal is making compliance considerations automatic rather than exceptional. When teams naturally ask compliance questions during planning sessions and incorporate regulatory impact into project timelines, the culture shift becomes self-reinforcing.

Creating Safety for Compliance Questions

Building compliance culture requires balancing enforcement with empathy. You want to encourage proactive issue identification rather than reactive problem-hiding.

Organizations must create environments where employees feel safe raising compliance concerns. No fear of retaliation or blame.

This balance starts with leadership responses to compliance mistakes. When team members make errors, leaders should focus on understanding root causes and improving systems rather than assigning individual fault.

Punitive responses drive compliance issues underground. This makes problems harder to detect and resolve.

Consider this scenario: An employee discovers that your customer onboarding process has been missing a required disclosure for three months. How does leadership respond?

Poor response: "Who's responsible for this? This is unacceptable."

Better response: "Thanks for catching this. Let's understand how this happened and fix our process so it doesn't happen again."

Statistics show that organizations with strong compliance cultures invest significantly more in creating open communication channels and psychological safety mechanisms.

Regular compliance conversations should feel collaborative rather than interrogational. Team members need:

- Clear escalation paths

- Documented decision-making processes

- Recognition for proactive compliance thinking that prevents larger issues

Early-Stage Culture Setting for Growth

Here's what most fintech founders get wrong: They think compliance culture can wait until later.

It can't.

Building strong compliance culture during early growth phases prevents the costly rework required when organizations try to retrofit compliance into established operational patterns. Startups and scale-ups have unique opportunities to build compliance thinking into their foundational processes.

Early-stage culture setting begins with incorporating compliance considerations into hiring decisions, performance metrics, and strategic planning processes. New employees should understand that compliance competency is as important as technical skills for long-term career success within the organization.

Growing fintechs often resist compliance investment. They fear it will slow innovation and growth momentum. However, the real barrier to growth isn't compliance itself. It's reactive compliance approaches that create bottlenecks and crises.

Think about it this way: Would you rather spend two hours building compliance into your product development process, or two months dealing with a regulatory enforcement action?

ComplyIQ's fractional services help establish compliance culture foundations that scale naturally as organizations grow. This approach allows growing companies to access Fortune 500-caliber compliance thinking while maintaining operational flexibility and cost control.

The key is building compliance muscle memory during lower-stakes periods. This way, teams can maintain standards when pressure intensifies. Organizations that invest in compliance culture early find they can move faster in competitive situations. Their teams automatically consider regulatory implications rather than discovering them as obstacles later.

Consider these early-stage culture builders:

- Include compliance scenarios in new hire orientation

- Add compliance impact questions to project planning templates

- Celebrate teams that proactively identify compliance issues

- Make compliance expertise a factor in promotion decisions

Conclusion

Compliance culture transformation starts with leadership commitment to consistent modeling.

Not policy memorization.

Organizations that treat compliance as a core operational capability rather than a sidecar function gain competitive advantages. They make faster decisions, reduce regulatory risk, and build stronger stakeholder confidence.

The companies that survive and thrive understand this truth: Compliance culture isn't a constraint on growth. It's what makes sustainable growth possible.

Fintech leaders who recognize this gap and invest in cultural integration position their organizations for long-term success in an increasingly regulated environment.

FAQs

How long does it take to transform compliance culture in an existing organization? Cultural transformation typically requires 12-18 months of consistent leadership modeling and system integration. The timeline depends on organization size, existing culture strength, and leadership commitment to change.

What are the early warning signs that compliance culture is failing? Key indicators include inconsistent policy application across departments, employees expressing confusion about decision-making authority, increasing near-miss incidents, and team members avoiding compliance discussions.

How can organizations measure compliance culture performance? Measurement combines behavioral indicators (proactive issue reporting, compliance question frequency), outcome metrics (audit findings, regulatory feedback), and employee surveys about psychological safety and clarity.

When should growing fintechs consider fractional compliance leadership? Organizations should consider fractional expertise when they need senior-level compliance guidance but aren't ready for full-time hires, typically during Series A growth phases or when preparing for regulatory licensing.

How do you handle employee resistance to increased compliance focus? Address resistance through transparent communication about business benefits, involving team members in solution development, and demonstrating how compliance thinking enhances rather than hinders their professional development.

What's the difference between compliance training and compliance culture? Training focuses on knowledge transfer while culture emphasizes behavioral integration. Culture change requires embedding compliance thinking into daily workflows, performance metrics, and decision-making processes.

Can compliance culture coexist with rapid innovation cycles? Yes, when compliance considerations are built into development processes from the beginning rather than added as review gates. This approach actually accelerates innovation by preventing late-stage regulatory roadblocks.